Introduction

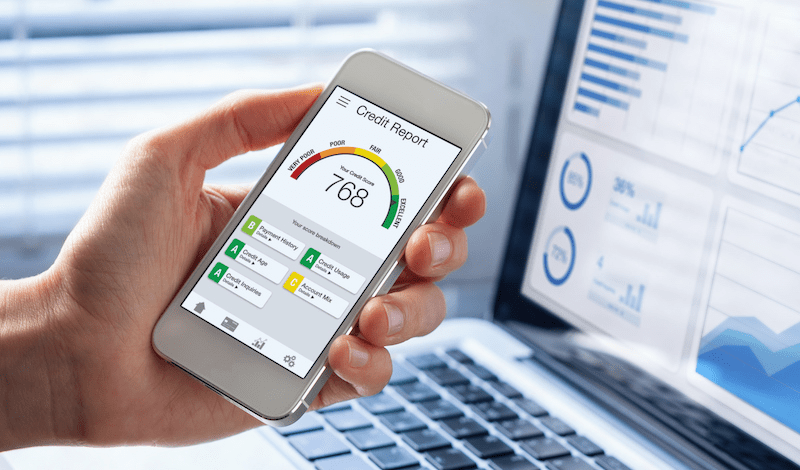

In the ever-evolving landscape of finance, the methods used to assess creditworthiness have witnessed a significant transformation. Traditional credit scoring, rooted in age-old practices, is now sharing the stage with AI-based credit scoring models. By understanding the differences, we can navigate the terrain of credit assessments more effectively, appreciating the advancements that AI brings to the table.

This comprehensive exploration aims to dissect the nuances and disparities between these two approaches, with a particular focus on unraveling the intricacies of the AI-driven credit scoring model – deciphering creditworthiness.

Traditional Credit Scoring: A Historical Perspective

1.1 The Foundation of Traditional Credit Scoring

Traditional credit scoring has long been the bedrock of lending decisions. It relies on historical credit data and predetermined metrics to evaluate an individual’s creditworthiness. The process involves assigning numerical scores based on factors such as payment history, credit utilization, length of credit history, types of credit in use, and new credit.

1.2 Limitations of Traditional Credit Scoring

1.2.1 Rigidity in Evaluation Criteria

Traditional credit scoring models often follow rigid evaluation criteria, making it challenging for individuals with non-traditional credit histories or those with limited financial footprints to secure credit.

1.2.2 Limited Predictive Power

The predictive power of traditional credit scoring models may be limited. These models rely heavily on historical data, potentially overlooking emerging patterns or shifts in borrower behavior.

1.2.3 Lack of Adaptability

Traditional models may struggle to adapt to changing economic landscapes or accommodate the evolving financial behaviors of individuals, leading to less agile credit assessments.

AI-Based Credit Scoring: The Technological Leap

2.1 The Emergence of AI in Credit Scoring

AI-based credit scoring marks a paradigm shift, introducing advanced machine learning algorithms to the creditworthiness assessment process. These algorithms leverage vast datasets, alternative data sources, and predictive analytics to provide a more nuanced evaluation.

2.2 Key Features of AI-Based Credit Scoring

2.2.1 Predictive Analytics and Machine Learning

AI-based credit scoring models leverage predictive analytics and machine learning algorithms to anticipate future credit behavior. This enables a more dynamic and forward-looking assessment of creditworthiness.

2.2.2 Alternative Data Integration

Unlike traditional models, AI-driven credit scoring incorporates alternative data sources such as social media activity, online behavior, and even rental histories. This widens the scope of evaluation, particularly benefiting individuals with limited traditional credit histories.

2.2.3 Real-time Decision-Making

The real-time processing capabilities of AI contribute to swift decision-making in credit assessments. This agility is crucial in meeting the expectations of borrowers seeking quick and efficient credit evaluations.

Deciphering Creditworthiness with AI-Driven Models

3.1 Predictive Power Beyond Historical Data

3.1.1 Anticipating Changing Behaviors

AI-driven credit scoring models excel in anticipating changing borrower behaviors. By learning from historical data and continuously adapting to new information, these models offer a more accurate prediction of future credit activities.

3.1.2 Proactive Risk Identification

The predictive power of AI extends to proactive risk identification. Machine learning algorithms can detect emerging risks in real-time, allowing for a more agile and responsive approach to risk management.

3.2 Alternative Data for Inclusive Assessments

3.2.1 Overcoming Data Limitations

AI-based credit scoring addresses the limitations associated with traditional models by incorporating alternative data. This is particularly advantageous in evaluating individuals with limited credit histories, providing a more inclusive assessment.

3.2.2 Diverse Metrics for Fairness

The use of alternative data contributes to a fairer evaluation by considering a broader set of metrics. This helps mitigate biases present in traditional credit scoring models and fosters inclusivity across diverse demographics.

3.3 Adaptive Learning for Dynamic Environments

3.3.1 Continuous Model Improvement

AI-driven credit scoring models embrace adaptive learning, continuously improving their predictive capabilities with each iteration. This adaptability ensures that credit assessments remain relevant in dynamic economic environments.

3.3.2 Evolving with Borrower Behavior

As borrower behavior evolves, so do AI-driven models. The ability to adapt to changing financial landscapes ensures that credit scoring remains aligned with the diverse and dynamic nature of borrower activities.

Comparing Traditional and AI-Based Credit Scoring Models

4.1 Evaluation Criteria and Factors

4.1.1 Traditional Metrics vs. Alternative Data

Traditional credit scoring relies on established metrics like payment history and credit utilization. AI-based models incorporate alternative data, including social media behavior and online transactions, offering a more comprehensive evaluation.

4.1.2 Rigidity vs. Flexibility

Traditional models may follow rigid evaluation criteria, making it challenging for certain demographics. AI-driven models introduce flexibility by considering a diverse set of factors, promoting fairness and inclusivity.

4.2 Predictive Capabilities

4.2.1 Historical Data vs. Forward-Looking Predictions

Traditional models base predictions on historical data, potentially missing emerging patterns. AI-driven models excel in forward-looking predictions, leveraging historical data while adapting to changing borrower behaviors.

4.2.2 Reactive vs. Proactive Risk Management

Traditional models are often reactive in risk management. AI-driven models proactively identify risks in real-time, enabling financial institutions to respond swiftly to emerging challenges.

4.3 Adaptability to Change

4.3.1 Limited Adaptability vs. Continuous Learning

Traditional models may struggle to adapt to changing economic landscapes. AI-driven models embrace continuous learning, ensuring they evolve alongside shifts in borrower behavior and market dynamics.

4.3.2 Speed of Decision-Making

Traditional models may involve lengthy decision-making processes. AI-driven models contribute to faster decision-making, aligning with the expectations of borrowers for swift credit assessments.

Challenges and Considerations

5.1 Interpretability and Explainability

5.1.1 Transparency in Traditional Models

Traditional credit scoring models are often perceived as more transparent, as the criteria for evaluation are well-established and widely understood.

5.1.2 Addressing the “Black Box” Perception in AI Models

AI-driven models may face challenges in addressing the “black box” perception, where borrowers and lenders may find it difficult to understand the complex algorithms driving credit assessments.

5.2 Data Privacy and Security

5.2.1 Handling Sensitive Information in Both Models

Both traditional and AI-based models must adhere to stringent data privacy regulations to ensure the security and confidentiality of sensitive borrower information.

5.2.2 Unique Risks of Alternative Data in AI Models

AI models using alternative data must navigate unique risks associated with the collection and utilization of non-traditional information, requiring robust cybersecurity measures.

5.3 Regulatory Compliance

5.3.1 Long-established Standards for Traditional Models

Traditional credit scoring models have long-established standards, making it relatively straightforward to comply with existing regulations.

5.3.2 Evolving Regulatory Landscape for AI Models

AI-driven credit scoring models operate in a rapidly evolving regulatory landscape, requiring careful navigation to ensure compliance with emerging standards.

Future Trends and Integration

6.1 Advancements in Explainable AI (XAI)

6.1.1 Fostering Trust through Transparency

The integration of Explainable AI (XAI) is a future trend that aims to enhance the transparency of AI-driven credit scoring models, making their operations more understandable to both lenders and borrowers.

6.1.2 Balancing Complexity with Explanation

As AI models become more complex, efforts to balance this complexity with clear explanations will be crucial for building trust and confidence in their use for credit assessments.

6.2 Continued Evolution of Alternative Data Usage

6.2.1 Expansion of Alternative Data Sources

The future holds the promise of an expanded array of alternative data sources, further enriching the information available for credit assessments.

6.2.2 Ethical Considerations in Alternative Data Usage

As alternative data usage expands, ethical considerations regarding the sourcing and use of this data will become increasingly important for ensuring fair and responsible credit assessments.

6.3 Collaboration Between Traditional and AI Models

6.3.1 Hybrid Approaches for Optimal Results

A potential future trend involves the collaboration between traditional and AI-based credit scoring models, leveraging the strengths of both approaches for more accurate and robust credit assessments.

6.3.2 Gradual Transition in Adoption

Financial institutions may adopt hybrid approaches gradually, allowing for a smooth transition and ensuring compatibility with existing systems and regulatory frameworks.

Conclusion: A Harmonious Blend for Credit Assessment

In conclusion, the differences between traditional credit scoring and AI-based credit scoring models are rooted in their evaluation criteria, predictive capabilities, adaptability, and decision-making speed. While traditional models offer transparency and long-established standards, AI-driven models bring predictive power, adaptability, and inclusivity.

As we navigate the future of credit assessments, a harmonious blend of both approaches may be the key. The integration of Explainable AI (XAI), advancements in alternative data usage, and collaborative hybrid models hold the promise of shaping a credit assessment landscape that is not only technologically advanced but also transparent, fair, and inclusive. By understanding these differences and embracing the strengths of each approach, the financial industry can pave the way for a more sophisticated and effective creditworthiness evaluation system.

Leave a comment